Trademark and licensing disputes are expected to increase in 2026 as brands expand faster than their legal frameworks. A Norton Rose Fulbright global litigation survey found that four in 10 companies view trademark and licensing disputes as their most significant legal exposure, a notable shift from prior years when regulatory and employment risks dominated.

Recent high profile disputes involving look alike products, failed brand collaborations, and post termination trademark use show how quickly branding decisions can escalate into litigation.

What does the Norton Rose Fulbright survey show?

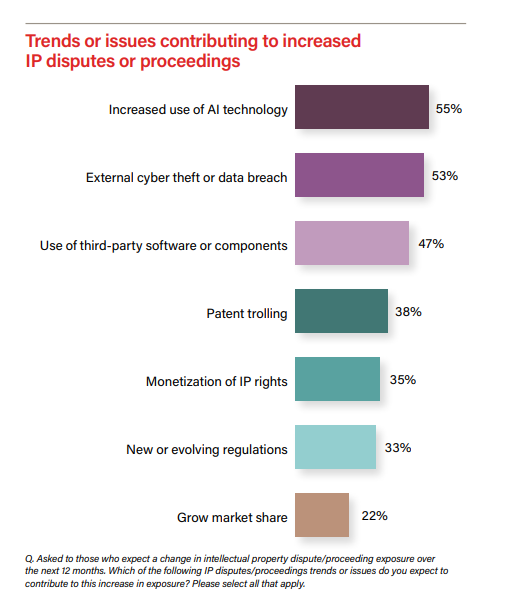

The Norton Rose Fulbright’s 2025 Annual Litigation Trends Survey is based on responses from hundreds of in house counsel and senior legal executives across industries, including consumer goods, retail, technology, food and beverage, and life sciences. Participants were asked to identify the areas where they expect the greatest litigation exposure in the coming year.

Trademark and licensing disputes ranked unusually high, outpacing several traditionally dominant risk categories.

That result is significant because it reflects anticipated disputes, not historical ones. In other words, companies are seeing trademark and licensing risk coming, even before claims are filed.

The survey also aligns with a broader trend. As brand value becomes more central to revenue, companies are increasingly willing to litigate to protect it, or forced to defend it when strategies collide.

Why are trademark and licensing disputes increasing?

Trademark disputes today are less about counterfeit goods and more about brand proximity, meaning how close one product, partnership, or message comes to another in the consumer’s mind.

Businesses are:

- Launching new product lines at speed

- Licensing brand names into unfamiliar categories

- Collaborating with influencers and celebrities

- Competing in markets saturated with visually similar products

When ownership, scope, or enforcement rights are not clearly defined, disputes are far more likely to follow.

What recent lawsuits reveal about current trademark risk

How look alike products are reshaping trademark enforcement

Consumer brands are increasingly bringing claims based on trade dress and overall commercial impression, even where logos differ.

Recent disputes involving drinkware, apparel, and consumer goods illustrate this shift. Plaintiffs focus on similarities in colors, shapes, packaging, and marketing cues, arguing that consumers are confused even if the brand name is different.

Why this matters:

Courts are being asked to draw fine distinctions between lawful competition and infringement in crowded retail categories. Outcomes are fact specific and difficult to predict, increasing risk for both brands and retailers.

Why licensing agreements tend to fail after success, not before

Many licensing disputes emerge only once a collaboration proves profitable.

Recent cases involve disagreements over:

- Ownership of trademarks created during the partnership

- Whether a license extends to new product categories or channels

- Whether brand use may continue after termination

Celebrity driven food, beverage, and lifestyle collaborations are particularly vulnerable when contracts focus on launch mechanics but fail to address long term brand control.

When branding itself becomes the legal exposure

Trademark risk is also appearing inside consumer lawsuits alleging misleading branding or false endorsement.

In several recent food and beverage cases, plaintiffs point not just to advertising copy, but to product names, logos, and brand identity that allegedly imply qualities the product does not have.

In these cases, trademark strategy intersects with consumer protection law, often expanding potential liability.

Which industries face the highest trademark and licensing risk in 2026?

Consumer goods and mass retail

This sector faces the greatest exposure due to:

- Private label expansion

- Dupe products with similar trade dress

- High product turnover and aggressive pricing

Retailers can face liability even when third party manufacturers design the product, particularly where the retailer controls branding or packaging.

Food and beverage brands

Trademark and licensing risk is rising as brands:

- License names into new food categories

- Partner with celebrities and creators

- Use branding that implies health, quality, or origin

Disputes in this space frequently combine trademark claims with state consumer protection statutes.

Fashion, beauty, and lifestyle companies

Brand identity is the product in these industries.

Risk drivers include:

- Similar logos, patterns, and packaging

- Social media driven brand recognition

- Global online sales without global trademark coverage

Dilution can occur quickly, prompting aggressive enforcement.

Influencer, creator, and celebrity led businesses

Many creator brands scale rapidly with limited legal infrastructure.

Common issues include:

- Unclear ownership between talent and operating partners

- Trademark filings made after public launch

- Licenses that fail to anticipate future revenue streams

When disputes arise, they are often public and reputationally damaging.

E-commerce and digital first companies

Online businesses face unique trademark challenges, including:

- Cross border sales

- Marketplace infringement

- Unauthorized resellers

Failure to police trademarks online can weaken enforcement rights over time.

How can companies reduce trademark and licensing risk before disputes arise?

From a trademark attorney’s perspective, most disputes are avoidable.

Conduct clearance before branding, not after marketing

Trademark clearance should occur before names, logos, or packaging are finalized.

This includes:

- Federal trademark searches

- Common law use analysis

- Industry specific risk review

Skipping this step often leads to forced rebranding or post launch litigation.

Register trademarks early and strategically

Registration provides nationwide priority and meaningful enforcement leverage.

Companies should:

- File as soon as use is planned or begins

- Register key brand elements, not just names

- Consider international filings where online sales are expected

Waiting can allow competitors, or even partners, to file first.

Draft licensing agreements with future success in mind

Licensing contracts should assume the brand will succeed.

Agreements must clearly define:

- Ownership of newly created trademarks

- Permitted product categories and channels

- Quality control standards

- Termination rights and post termination brand use

Ambiguity becomes costly once revenue grows.

Monitor and control brand use by partners and affiliates

Trademark owners are required to exercise quality control.

Best practices include:

- Approval rights over packaging and marketing

- Audit provisions

- Clear enforcement protocols

Uncontrolled licensing can jeopardize trademark validity.

Enforce consistently or lose leverage

Selective enforcement creates legal risk.

If a company tolerates some unauthorized uses while challenging others, it may face defenses based on acquiescence or weakened rights. Consistent enforcement preserves credibility.

Juris Law Group advises businesses on trademark clearance, licensing strategy, and dispute prevention, helping brands grow without undermining their most valuable assets.

Frequently Asked Questions (faq)

Do similar looking products automatically infringe trademarks?

No. Courts analyze consumer confusion, trade dress distinctiveness, and overall commercial impression.

Can failing to enforce a trademark weaken rights?

Yes. Failure to police unauthorized use can undermine enforceability.

Are licensing disputes becoming more common?

Yes, particularly after collaborations become profitable.

Should startups address trademark risk early?

Yes. Early mistakes often limit growth or force expensive corrections later.

Key takeaway

The Norton Rose Fulbright survey confirms what many companies are already experiencing. Trademark and licensing risk is no longer peripheral. In 2026, brand growth without legal planning is one of the fastest paths to avoidable litigation.