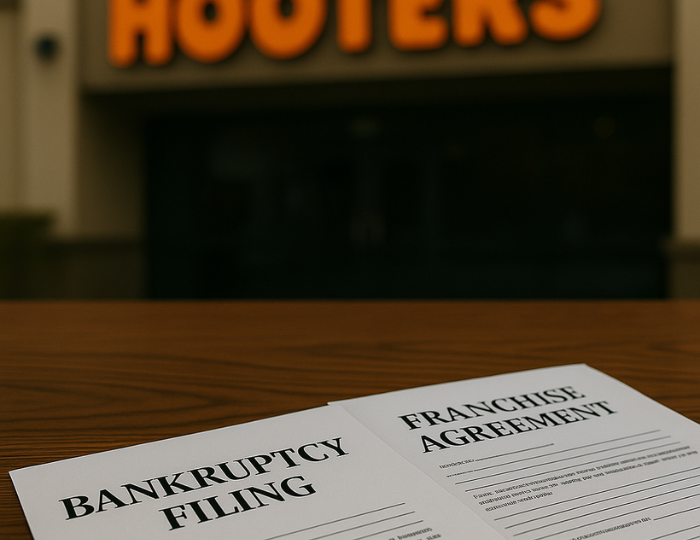

In a strategic move to address financial challenges, Hooters of America, LLC has filed for Chapter 11 bankruptcy protection in the North Texas Bankruptcy Court in Dallas. This decision aims to facilitate a sale of company-owned restaurants to a group of franchisees, including the original founders, thereby transitioning the company to a fully franchised business model.

Background of the Bankruptcy Filing

Hooters of America, LLC filed for Chapter 11 bankruptcy protection in March 2025 in the U.S. Bankruptcy Court for the Northern District of Texas. The filing marks a significant moment for one of America’s most recognizable restaurant brands, known for its sports-bar atmosphere and casual dining concept built around its “Hooters Girl” brand identity. The company is reportedly facing over $376 million in liabilities, prompting this restructuring effort to address long-standing financial pressures.

The decision to pursue bankruptcy was largely driven by a combination of high operational costs, shifting consumer expectations, increased competition, and lingering post-pandemic economic challenges. The casual dining sector, in particular, has been heavily impacted by the rising costs of labor, food inflation, and a growing preference among younger consumers for healthier and more inclusive dining experiences. Despite its legacy and brand recognition, Hooters has struggled to maintain profitability across its corporate-owned locations.

Rather than liquidating assets, the company’s leadership opted for a strategic Chapter 11 filing to facilitate a sale of more than 100 corporate-owned stores to a group of experienced franchisees, including members of the company’s founding leadership. The goal is to restructure into a fully franchised model, allowing the company to retain the Hooters brand without the financial burden of directly operating restaurants.

Implications for Franchisees and Licensees

The transition to a 100% franchised operation carries considerable implications for both current and prospective Hooters franchisees. For existing franchise owners, the bankruptcy filing might appear alarming at first glance. However, since franchised locations are legally separate entities, most existing franchises will not be directly affected by the debt restructuring. Nevertheless, the restructuring could lead to changes in corporate support, branding oversight, supply chain arrangements, and franchise fee structures.

The restructuring process also presents new opportunities for expansion. Franchisees may find themselves with more room to grow under a leaner, franchise-focused corporate model. The company has indicated that the new ownership group—led by franchisees with strong operational backgrounds—plans to reinvest in the brand’s fundamentals and modernize the customer experience.

However, licensees and franchisees must be vigilant. Changes in ownership or corporate structure can lead to modifications in licensing agreements, royalty obligations, or brand usage rights. If the restructuring leads to a change in how the Hooters brand is managed or the IP is handled, franchisees may need to renegotiate terms or assert rights granted under their current agreements.

Legal Considerations in Franchise Transitions

Franchise transitions that occur during or following a bankruptcy involve significant legal complexity. Under Chapter 11 of the U.S. Bankruptcy Code, a debtor can reject or assume contracts—meaning that franchise or licensing agreements may be scrutinized, renegotiated, or terminated depending on their perceived value to the estate.

One of the key issues in Hooters’ case will be the handling of intellectual property rights, particularly trademarks. While licensees can preserve rights to patents and copyrights through §365(n) of the Bankruptcy Code, trademarks are not automatically protected in the same way. Franchisees must be proactive in asserting contractual rights and preparing to negotiate with new owners of the IP, especially if the transfer includes brand assets.

Another area of concern is “free and clear” asset sales under §363. If Hooters sells assets to the new franchisee group, it could include language that terminates or modifies existing licenses unless franchisees take legal action. To protect their interests, franchisees should engage bankruptcy counsel to track filings, assess potential risks to their contracts, and ensure their rights are not extinguished through the restructuring.

Finally, this transition is a reminder of the importance of carefully structured franchise agreements, including provisions for ownership change, brand use, dispute resolution, and continuity of service.

Impact on the Restaurant Industry

Hooters’ bankruptcy reflects a broader shift taking place in the restaurant industry, particularly among legacy casual dining chains. The competitive landscape has become increasingly difficult for brands that once dominated the market through thematic experiences and standardized menus. The rise of fast-casual concepts, app-based ordering, third-party delivery services, and wellness-conscious consumers has forced traditional brands to reassess their operating models.

More restaurant chains are now turning to franchise-heavy or asset-light models to remain profitable and reduce financial exposure. This allows companies to focus on branding, marketing, and supply chain management while relying on franchisees to manage day-to-day operations. Hooters’ pivot is part of a trend that includes other chains like Applebee’s, Ruby Tuesday, and TGI Friday’s, many of which have similarly restructured in recent years.

The bankruptcy also reveals vulnerabilities in business models heavily tied to brand nostalgia or controversial marketing strategies, especially those struggling to evolve with changing cultural expectations. Hooters’ effort to “return to the brand’s roots” will be closely watched to see whether a shift in leadership and a more localized ownership structure can revive consumer interest without alienating new demographics.

Future Outlook for Hooters

Despite the current challenges, Hooters’ leadership has expressed confidence in the restructuring process and believes the company will emerge from bankruptcy within 90 to 120 days. With $35 million in debtor-in-possession (DIP) financing, the brand expects to maintain uninterrupted operations while facilitating the sale of corporate stores to its founding franchisee group.

This transition presents a chance for the company to reset its public image, refine its customer experience, and streamline operations under more agile local ownership. The new franchisee group has pledged to invest in menu innovation, facility upgrades, and potentially more inclusive branding—all aimed at reengaging a broader customer base.

Yet, the road ahead isn’t without risks. Success will depend on how well the company manages legal complexities, supports its franchisees, and adapts to evolving consumer tastes. Any missteps in post-bankruptcy implementation—such as unclear communication, loss of brand consistency, or regulatory mismanagement—could compromise the revitalization effort.

For now, franchisees and stakeholders are cautiously optimistic. If executed well, this restructuring could offer a blueprint for other legacy restaurant brands seeking to navigate financial distress while preserving their cultural and economic relevance.

Q&A Section

Question 1: What does Hooters’ bankruptcy mean for existing franchisees?

Answer 1: Existing franchisees are expected to continue operations as usual. The bankruptcy primarily affects company-owned locations transitioning to franchise ownership. Franchisees should stay informed about any changes in corporate policies or brand guidelines resulting from the restructuring.

Question 2: Will Hooters restaurants remain open during the bankruptcy process?

Answer 2: Yes, all Hooters locations are anticipated to remain open and operational during the Chapter 11 proceedings. The company aims to ensure minimal disruption to customers and staff during this period.

Question 3: How might this restructuring impact potential franchisees?

Answer 3: Potential franchisees may find new opportunities to invest in Hooters locations as the company shifts to a fully franchised model. It’s essential for interested parties to conduct thorough due diligence and understand the terms of franchise agreements in the context of the company’s restructuring.

Question 4: What legal steps should franchisees take during this transition?

Answer 4: Franchisees should consult with legal counsel to review their franchise agreements, ensure compliance with any new corporate policies, and understand their rights and obligations during the restructuring process.

Question 5: How does this move reflect broader trends in the restaurant industry?

Answer 5: The shift towards franchising is a common strategy among restaurant chains to reduce operational costs and leverage local market expertise. Hooters’ move aligns with this trend, aiming to strengthen its brand through experienced franchise partnerships.

Final Thoughts

Hooters of America’s decision to file for Chapter 11 bankruptcy and transition to a fully franchised model marks a significant shift in its business strategy. This move underscores the importance of adaptability in the dynamic restaurant industry, where brands must continually evolve to meet changing consumer preferences and economic challenges.

For franchisees and licensees, this transition presents both opportunities and responsibilities. Aligning with the restructured corporate framework requires a thorough understanding of new operational standards, compliance with legal obligations, and a commitment to maintaining the brand’s integrity.